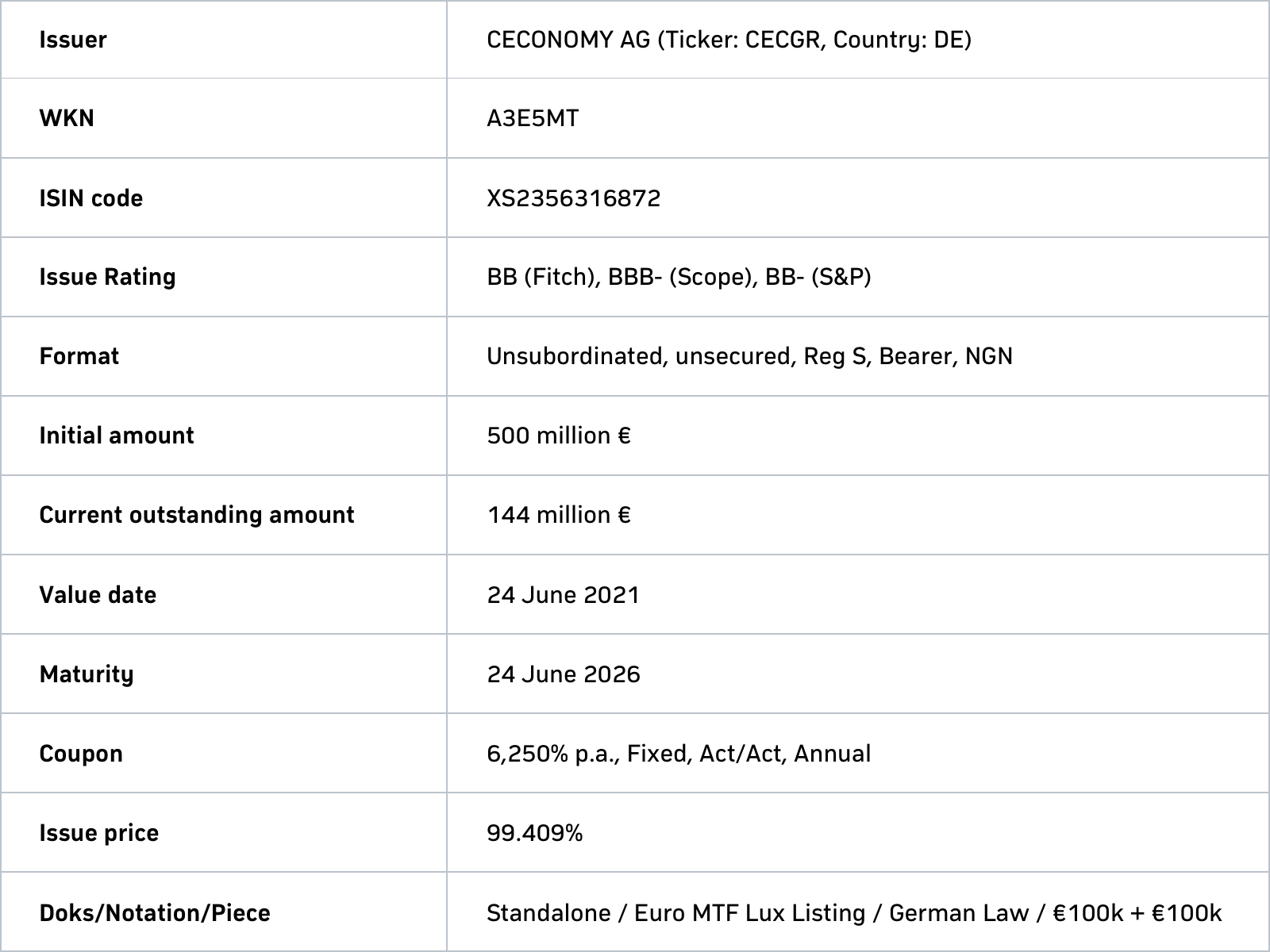

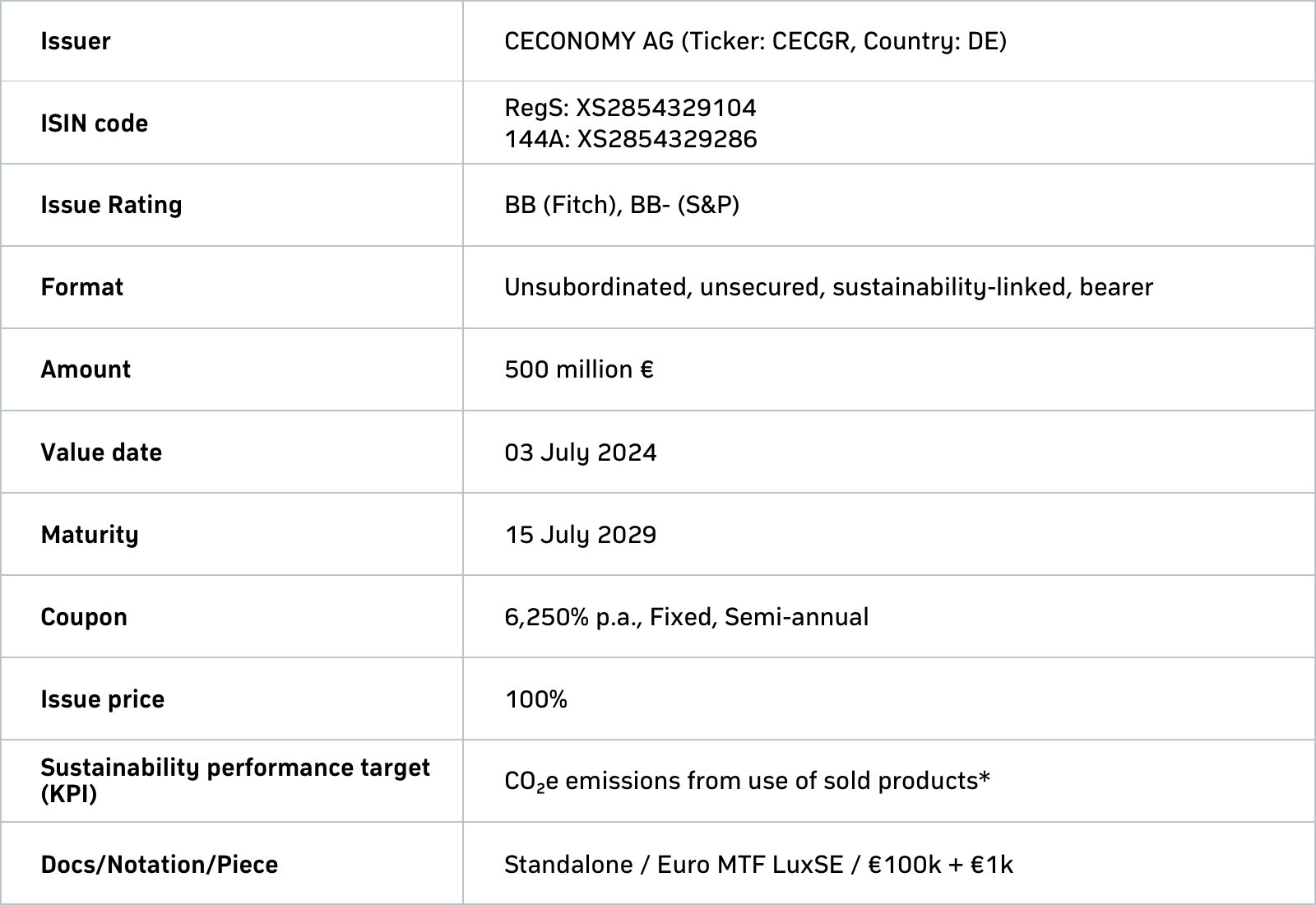

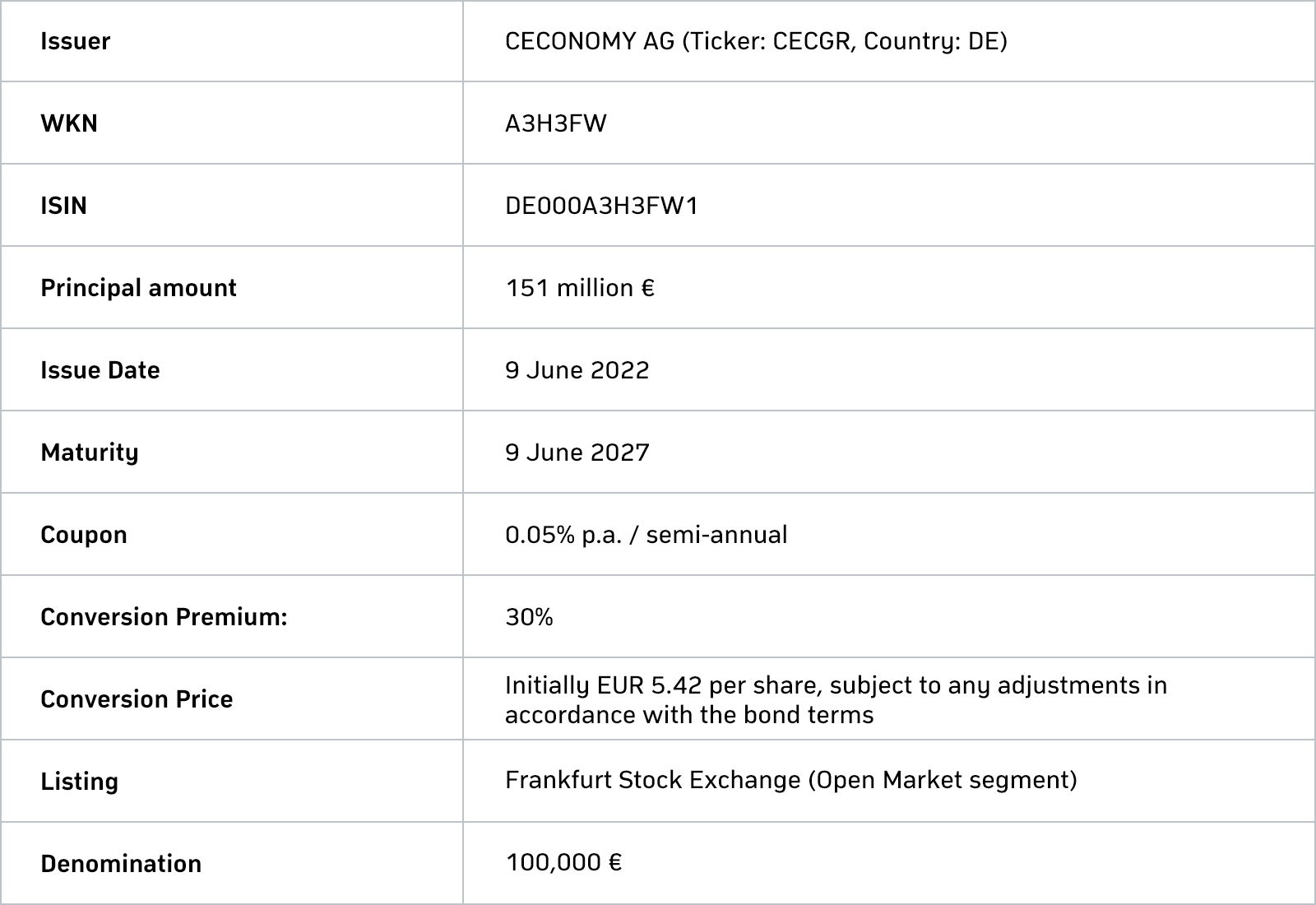

Ratings

CECONOMY AG adheres to the principle of a prudent financial policy and is continuously evaluated by three rating agencies, Fitch, Scope and S&P. Ratings evaluate the ability of a company to meet its financial obligations. They communicate the creditworthiness of a company to potential debt capital investors and enable it to obtain attractive financing conditions on international capital markets.